We started Octant as an ambitious experiment last year. Throughout this journey, we've faced challenges and gained many insights. As we’ve been reflecting on data from the past six months, we’ve had to reevaluate our initial assumptions. Now that epoch 2 has ended, we’re excited to share some of our learnings with you. At this critical juncture, one thing is clear to us: Octant’s framework needs to change.

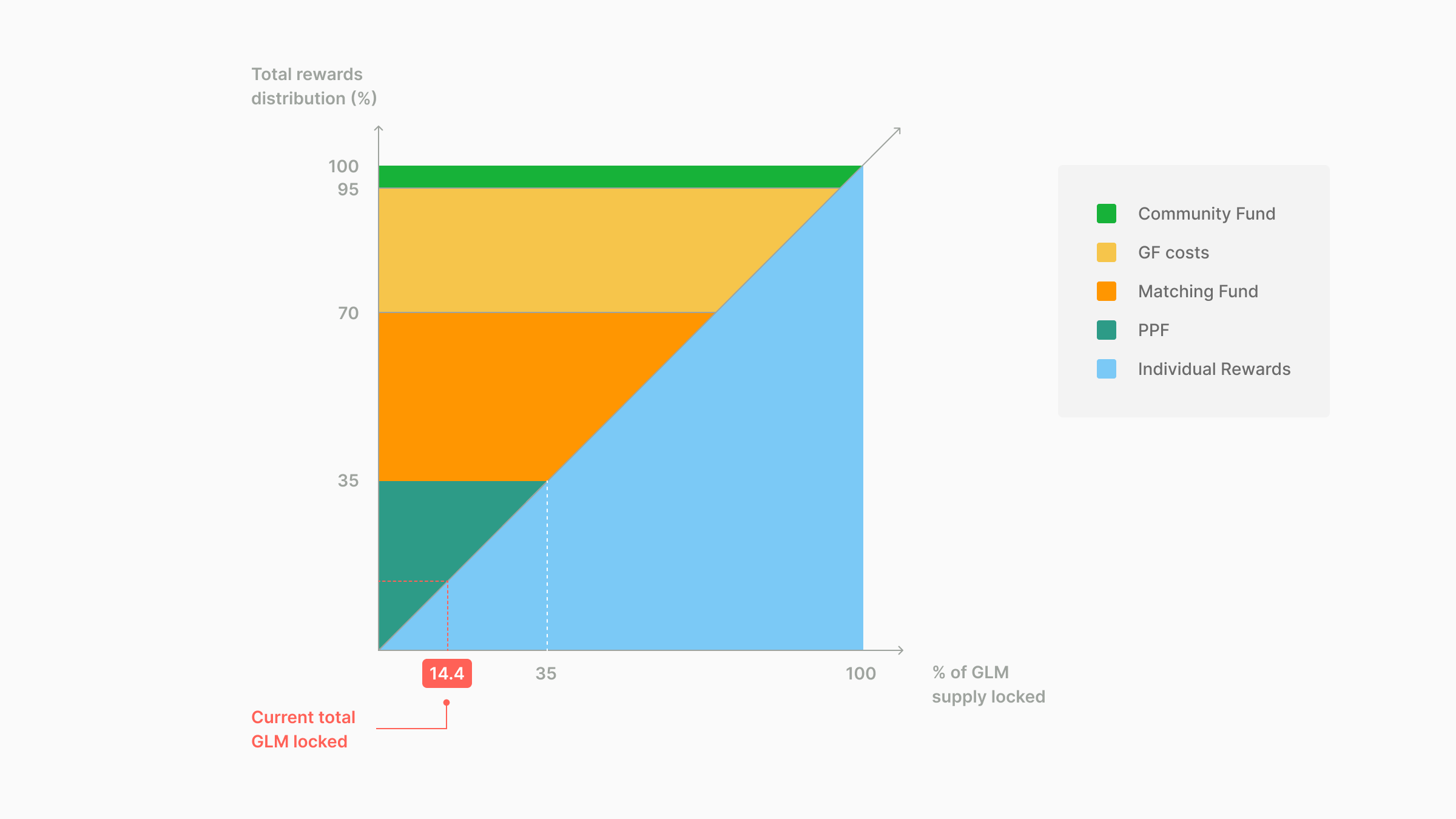

Our first and most crucial observation is that only 14.4% of the total GLM supply is currently locked in Octant. This falls short of our expectations. This level of participation has resulted in a considerable portion of the staking rewards reverting to the Golem Foundation. Originally, this design aimed to cover operational costs and increase the number of ETH validators to ensure the long-term sustainability of the ecosystem. However, we don’t think that’s enough.

Presently, ~14.4% of the staking rewards benefit individual users, while about 23.5% support public goods projects. Over 60% of the rewards are allocated to the Golem Foundation, either covering operational costs or contributing to validator expansion.

This imbalance deviates from our core mission: To become the first self-sustaining Public Goods Funding (PGF) ecosystem that financially empowers both public good projects and its community. With the majority of funds not effectively serving this purpose, we feel the need for a strategic realignment.

In this post, we will unveil the adjustments planned for epoch 3. These changes are focused on realigning Octant’s mechanism with our mission to ensure a more enhanced and transparent distribution of rewards.

So what’s changing at Octant?

After carefully considering our situation, we’ve decided to update the allocation of the Foundation’s staking yield to more closely reflect our mission:

- Our commitment to the method of calculating Individual Rewards (IR) remains strong. For every percent of the total GLM supply you lock in Octant, you will receive an equivalent percent in user rewards. This simple and direct formula is a cornerstone of Octant, and it will not be changing.

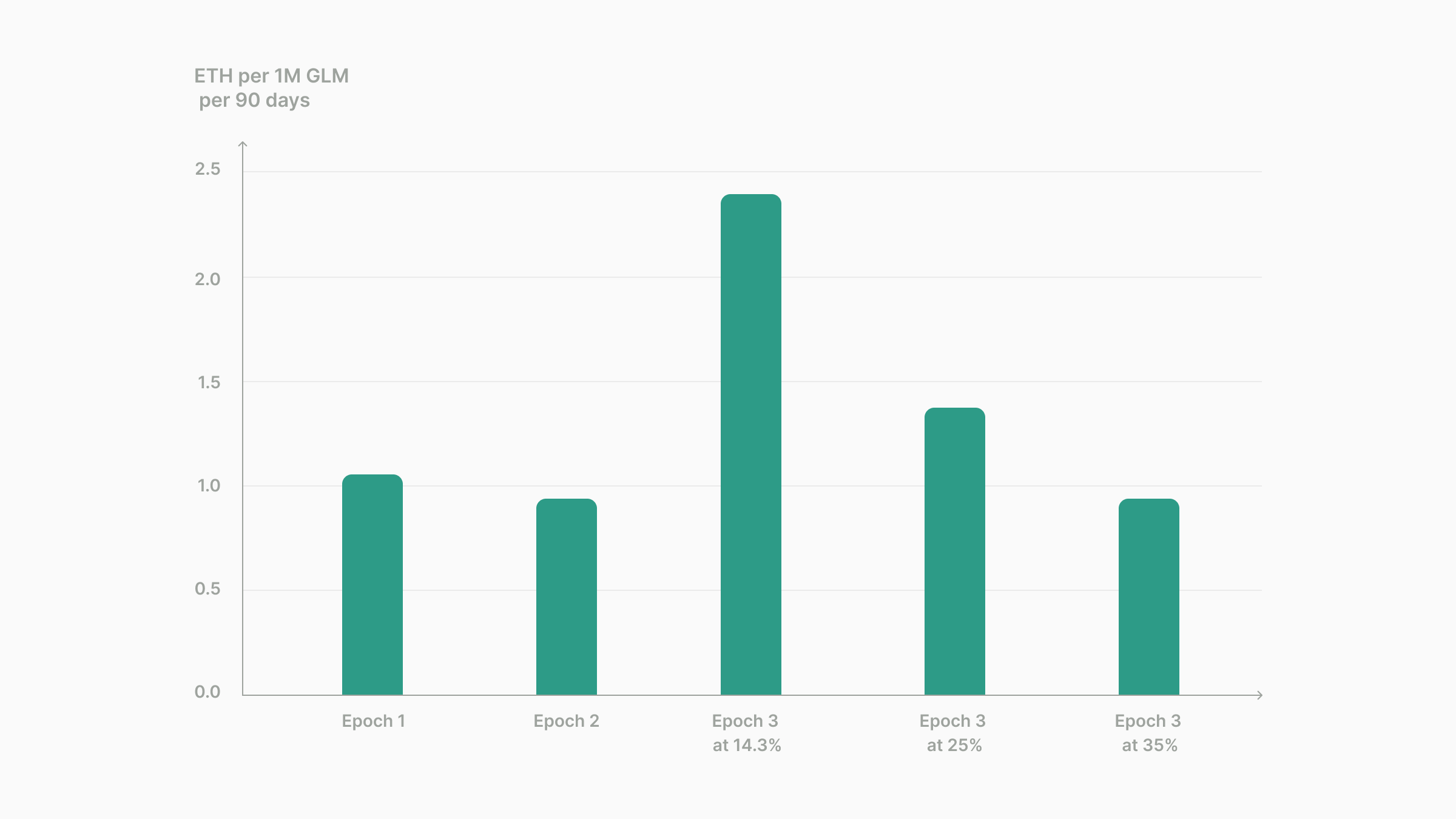

- While Individual Rewards will follow a consistent, linear pattern, we’ve identified an opportunity to offer additional benefits when the total GLM locked in Octant is relatively low. In epoch 3, we’re introducing the Participation Promotion Fund (PPF), a fund that’s been designed to supplement rewards for GLM lockers. This fund will provide incremental boosts to user rewards and will decrease periodically as more GLM is locked, phasing out completely at a 35% lock-in rate. Fifty percent of the PPF will boost users' ETH rewards, while the other half will be allocated for a special $GLM-related incentive, details of which will be shared soon. The use of the PPF may change over time, to ensure we can best cater to the needs of our Octant community.

- Matched rewards, allocated solely to public goods projects, will receive a stable 35% of staking rewards when GLM locking is below 35%. If the locking exceeds this threshold, the allocation will adjust to ensure balanced, ongoing support.

- We’re also launching the Octant Community Fund, allocating 5% of the yield to initiatives governed by our community members.

- To support our operations and future development, the Golem Foundation will receive 25% of the yield. This allocation is crucial for the continued success and growth of Octant and our broader ecosystem.

How can you get involved?

📌 Join us on Twitter Spaces

We’re unveiling the latest Octant updates and will be sharing details of our 2024 roadmap, on Spaces.

When: 25 January 2024 | Thursday @ 10 am PST.

➡️ Click here to register

📌 Help shape our governance

We’re redefining governance at Octant, and we’d love for you to be part of it. Get a front-row seat to our journey, and learn how you can actively shape our community-led governance.

➡️ Head over to discuss.octant.app to share your thoughts. Dive into the details, ask questions, and help shape Octant’s future.

FAQs

1. How have Golem Foundation’s staking returns been allocated so far?

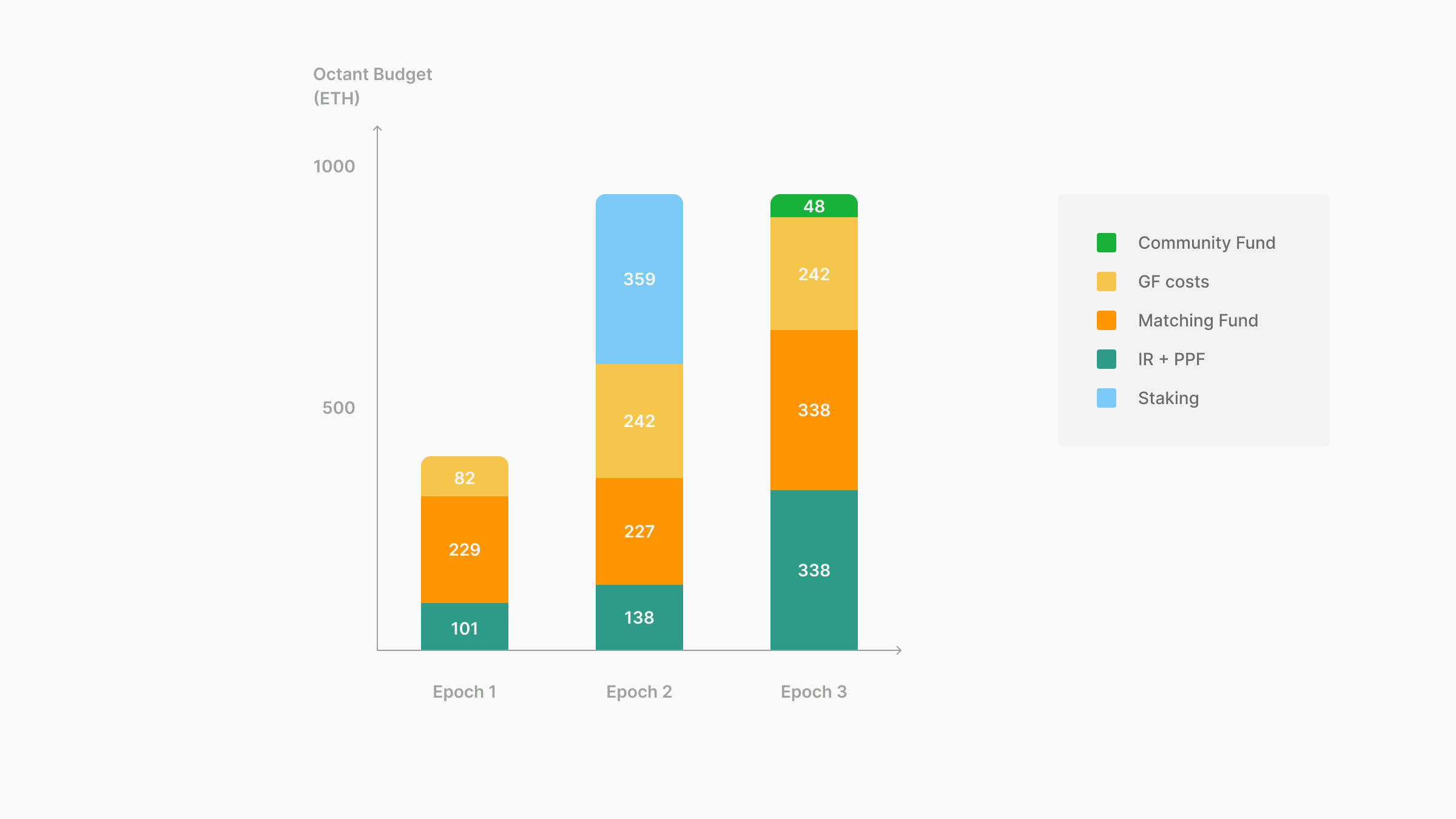

The distribution of staking returns has evolved with each epoch.

In epoch 1, we deviated from the original Octant paper’s formula, allocating 20% of staking returns to the Foundation for operational costs and dedicating the remaining 80% as Octant’s initial budget. This adjustment allowed us to open the first allocation window sooner than the planned 90 days post-launch, while still providing substantial funding for Octant. At the close of this window, 5.56 ETH stayed in Octant’s multisig due to users not taking action or supporting projects that fell short of the funding threshold.

In epoch 2, we introduced the square root algorithm outlined in the Octant paper. This meant 14.3% (138 ETH) of staking returns were allocated to Individual Rewards and 23.5% (227.3 ETH) to the Matching Fund. The Foundation retained 25% (241.7 ETH) for expenses, with the remaining 37.2% (359 ETH) increasing the staking pool and facilitating new validators.

For epoch 3, the fund distribution follows the plan announced here, leaving no extra funds for expanding our staking pool. Assuming consistent ETH yields, we foresee 338 ETH for both Individual Rewards and the Project Promotion Fund (PPF), 338 ETH for the Matching Fund, 48 ETH for the Community Fund, and 242 ETH for the Foundation.

Epoch 2 estimate, epoch 3 - projection assuming effective lock lower than 35% and staking APR at the level of epoch 2.

2. What led the Foundation to allocate 25% of staking revenue for operational costs?

Our launch of Octant involved committing nearly all our ETH reserves to staking. Currently, every aspect of the Foundation’s operations – including validator management, Octant administration, development, marketing, and other projects – relies entirely on staking proceeds for funding. At present market rates, the 25% allocation isn’t enough to meet all these expenses. Nonetheless, we are optimistic that with the resources we have at hand and a strategic approach to liquidating ETH, we can maintain the Foundation’s activities using this source of income.

3. What is the connection between Individual Rewards and the effective GLM lock?

The relationship is direct and linear: the proportion of the total GLM supply that a user locks corresponds to the same percentage of the total staking revenue allocated to that user. For instance, if your effective lock is 0.1% of the GLM supply, you are attributed 0.1% of the epoch’s total staking revenue. Currently, this translates to roughly 1 ETH for every 1 million GLM locked. This straightforward formula is fundamental to Octant, and we anticipate it will remain consistent over the long term.

However, considering the relatively low percentage of GLM currently locked in Octant, we have introduced the Participation Promotion Fund (PPF). This fund provides additional rewards to users when the total effective lock is below 35% of the GLM supply. While the specific application of the PPF may change from one epoch to another, in Epoch Three, half of it will simply be added to the Individual Rewards, resulting in increased rewards for all users as long as the effective lock stays below 35% of the GLM supply.

4. How long will Octant continue?

We’re committed to Octant for the long haul. We’ll keep building Octant, in line with our principles, as long as staking yields sufficient benefits for both GLM token holders and the funding of web3 public goods.

5. What is the Golem Foundation’s GLM holding?

The Foundation holds approximately 92 million GLM, which is about 9.2% of the total supply. These holdings are currently treated as the Foundation’s reserve assets. In the short to medium term, we do not plan to use them for any purpose other than the limited vesting for our team members. While some of these funds constitute part of the Foundation’s initial capital, the majority comes from portfolio rebalancing actions undertaken by the Foundation to reduce our ETH exposure and increase our GLM holdings.

6. Does the Golem Foundation intend to lock its GLM in Octant?

We strongly believe that the Golem Foundation (or Factory) locking GLM in Octant would undermine the system’s primary objective. Thus, we don’t have any plans to do so.

7. Got more questions about Octant?

Head over to our Discord or Discuss, and ask away!